Food Security and Access to Medicine

Through nearly US$1 billion in innovative sovereign trade financing, we have delivered over 976,000 tons of basic foods and non-edible goods, as well as over 948 million units of essential medical supplies and pharmaceuticals to approved local importers in Angola.

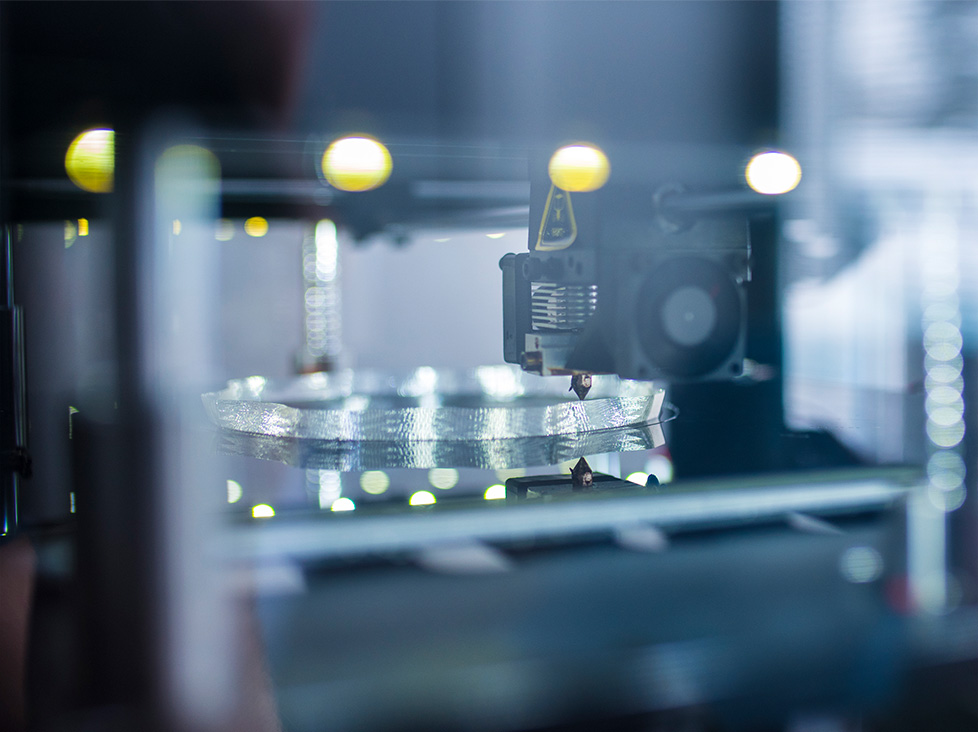

In order to ensure the quality and proper handling of pharmaceutical goods delivered to Angola, we have established a pharmaceutical warehousing complex close to Luanda, helping to close a critical infrastructure gap in the healthcare supply chain.