Just like so-called Developed Markets (or DM), the world of Emerging Markets (or EM) consists of a wide spectrum of investable asset classes, including:

1) hard currency sovereign and corporate bonds,

2) government bonds in local currency,

3) equities principally denominated in local currency and

4) structured loans and private equity.

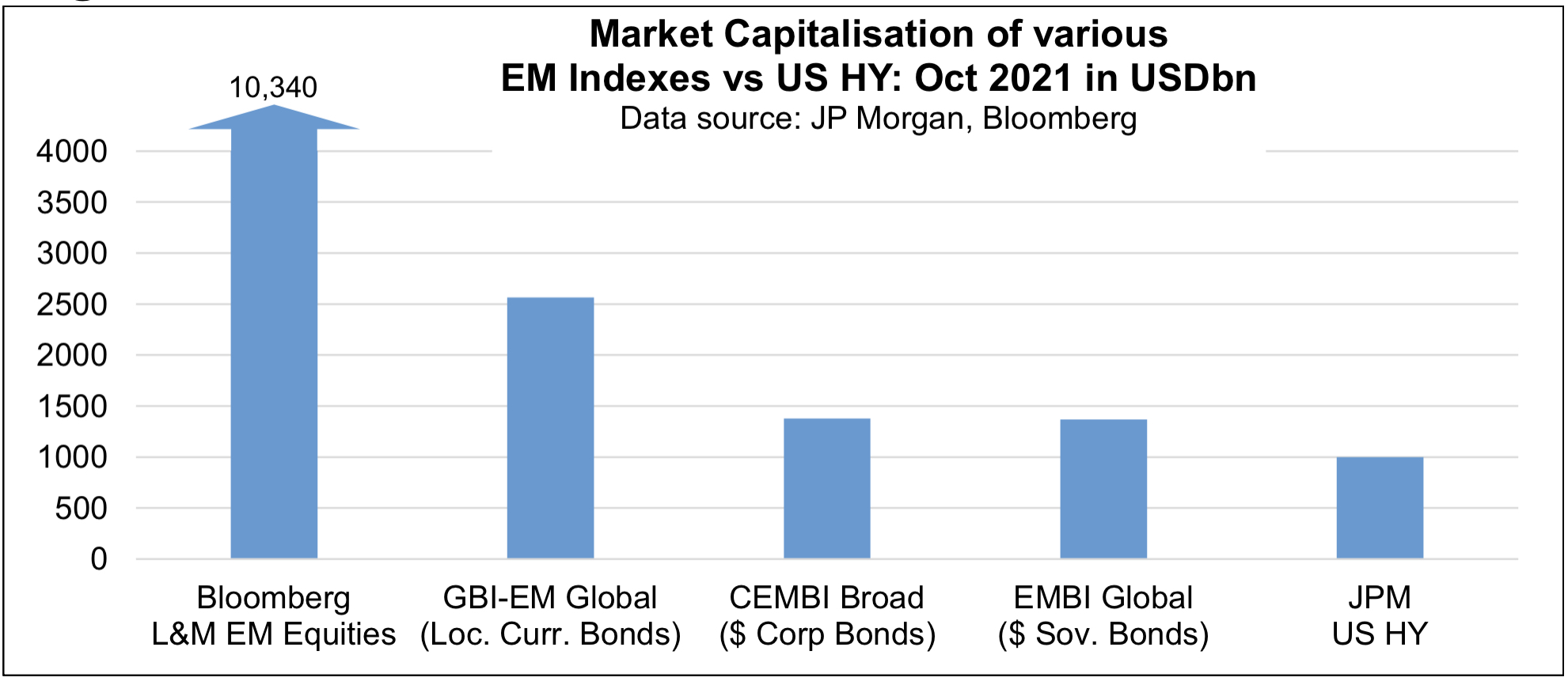

As figure 1 highlights, these asset classes have grown to sizeable investment alternatives to DM peers, even if China accounts for 35-40% of the local currency bond and equity indexes.

Figure 1: Market Capitalisation of various Emerging Market Indexes

As we discussed in our overview of “What are Emerging Markets?”, the widely used US dollar sovereign bond indexes in EM contain instruments (or so-called Eurobonds) from more than 70 heterogeneous developing countries, providing for an inherent amount of diversification.

Local currency bond indexes, on the other hand, consist of around 20 countries, a function of the fact that local bond markets in most emerging economies still need to be developed. The same goes for global Emerging Market equity indexes, which are usually made up of over 25 countries, similar to the number of countries in developed market equivalents.

THE RISKS OF INVESTING IN EMERGING MARKETS

Investors tend to see Emerging Markets as “higher risk” asset classes, often comparing these assets to high yield bonds in the DM space or to DM equities. There are numerous reasons for this, including: 1) a similar ratings profile, 2) the currency risk involved with investing into local currency EM assets, 3) the corresponding exposure of emerging economies to shifts in developed market central bank policies (especially the US Fed), 4) the sensitivity of EM assets to both domestic political and geopolitical noise and 5) the higher exposure of EM countries to the whims of international commodity prices, depending on whether a country is a net exporter or importer of those commodities.

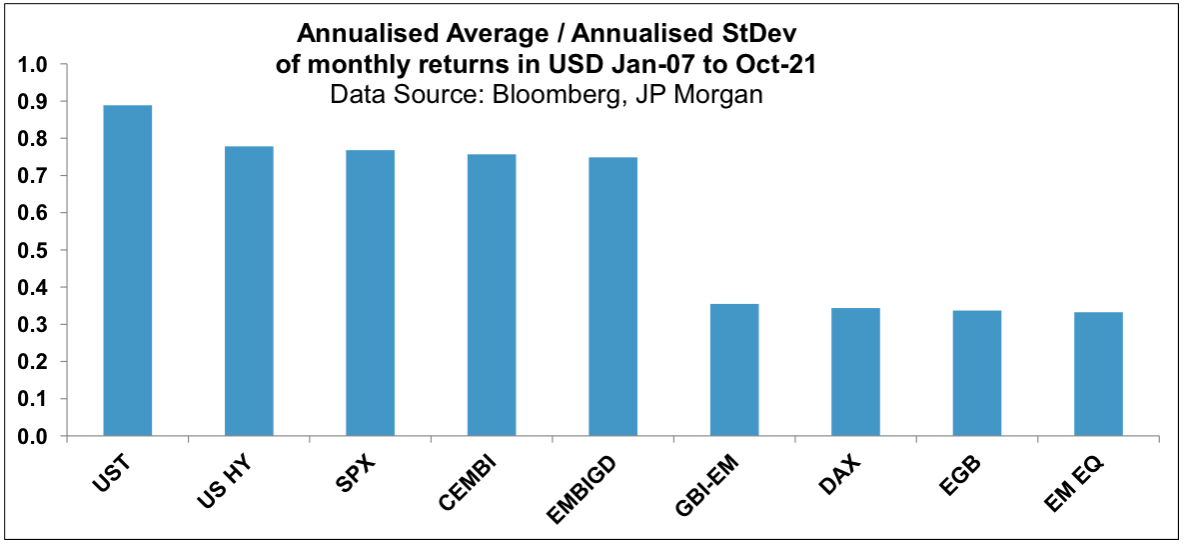

The relative advantage of Emerging Markets hard currency bonds is that they are less directly exposed to changes in exchange rates, something that is reflected in the superior risk/return profile of EM hard currency assets versus their local currency counterparts (Figure 2), placing them alongside the likes of US HY and US equities.

Figure 2: Annualised Average / Annualised StDev of monthly returns in USD

Nonetheless, EM hard currency bond investors are always on the lookout for any weakening of EM currencies that exposes countries to higher import costs in local currency and thus higher inflation too. In addition, a weaker EM currency at any particular point in time raises the value of external or hard currency debt when expressed in local currency, thus also causing an increase in debt/GDP ratios.

GEMCORP CAPITAL & INVESTING IN EMERGING MARKETS

On top of the standard macro variables that investors in DM focus on, such as GDP growth, inflation and interest rates, there is a wide spectrum of macro data that their peers in EM have to follow, including the balance of payments backdrop, central bank FX reserves, unemployment rates and GDP per capita ratios, with the latter two being indicators for any possible social discontent.

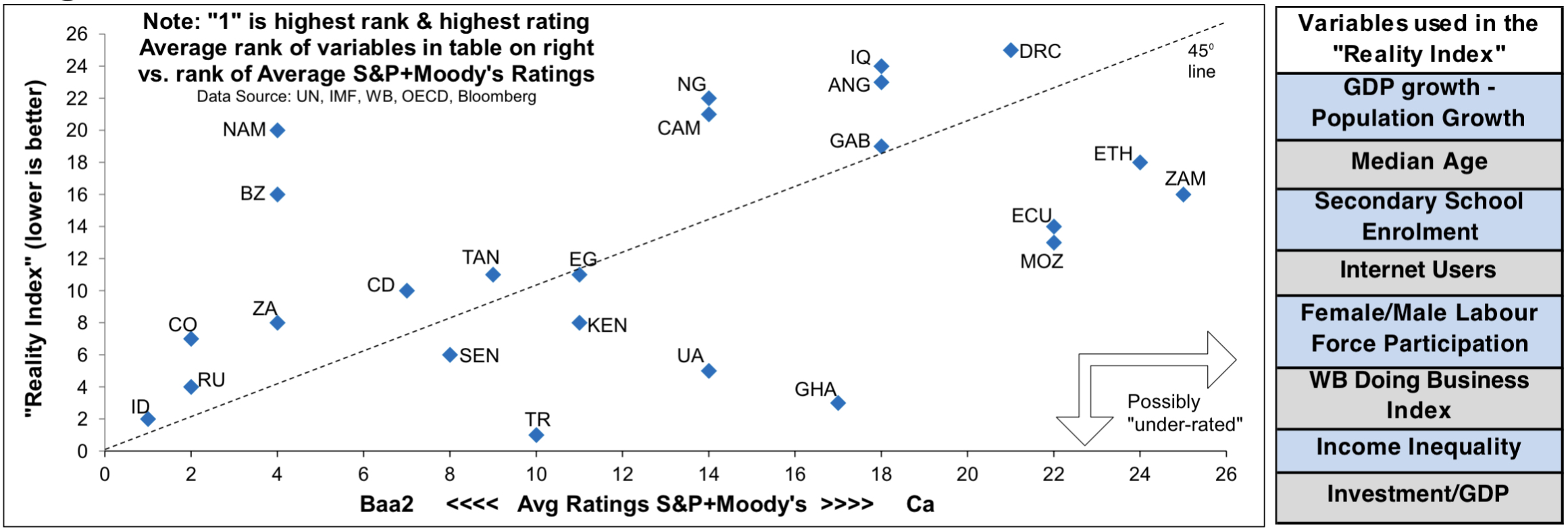

Indeed, investing in EM is not just about observing and acting on quantitative data points. As a dedicated EM asset manager, at Gemcorp we also focus on qualitative factors including: 1) access to the internet, access to education and female/male labour force participation rates (all standing as proxies for democratisation and inclusion), 2) GDP growth vs. Population growth and 3) income inequality ratios. We combine these and other variables to create a so-called “reality index” that ranks countries according to their average performance in qualitative factors. These rankings are then compared to the countries’ relative standing in ratings of S&P and Moody’s.

Figure 3 summarizes the comparisons: those countries below the 45 degree line are theoretically “under-rated” according to a “reality index”, including the likes of Ghana, which has indeed been through a process of empowering civil society in recent years. This approach can also provide information on the relative progress that other countries, such as Angola, are likely to make by following a similar path, ultimately resulting in ratings improvements and tighter bond spreads (as Angola has seen in 2021).

Combined with our bottom-up process for discovering potential projects across the African continent, this top-down “qualitative” approach helps us identify country-by-country opportunities that we feel are not readily reflected in the relatively negative assessment of ratings agencies, especially when it comes to Sub-Saharan Africa.

As has become clear over the decades, investing in Emerging Markets requires a considerable amount of understanding and analysis across a wide spectrum of disciplines. Whilst challenging, the world of Emerging Markets is also a fascinating one that offers the opportunity to work with governments, international organisations and corporates to support growth and reforms, in turn reducing countries' cost of borrowing and raising their ratings profile.

This document has been issued by Gemcorp Capital LLP (“Gemcorp”), which is authorised and regulated by the Financial Conduct Authority (the “FCA”).

This does not constitute an offer to sell or issue any interests in any transaction. The information in this document has been obtained from various third-party sources, some of them forward looking statements and projections. No representation is made or assurance given that such statements, opinions, estimates, projections or forecasts in this document are complete or correct or that the objectives set out in this document will be achieved. Gemcorp accepts no liability for such third-party information or the conclusions set out herein.